Business Loans for Startups in India 2021

What are small business loans?

Small business loans are flexible forms of

loans that can be used for anything related to business. It is very important

to get a business loan in order to meet the expenses related to expansion and

growth. Make sure you get a small business loan in order to use funds for

growth, expansion, emergency, or purchasing machinery or equipment. Since it is

an unsecured form of loan, there is no need for collateral or security to be

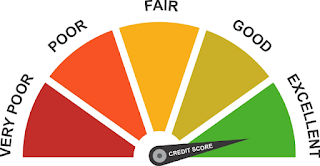

placed with the bank or non-banking financial companies.Read how to check credit score

The benefits of having a business loan for startups

●

A business loan can be used for

startups to expand. Startups are small-sized businesses, but they have every

plan to expand in terms of infrastructure, product line, or service. In order

to expand, they are always in need of a huge source of funds, which they can

meet with a small business loan.

●

Small businesses are able to

manage business emergencies with the help of a small business loan. There are

various kinds of external and internal threats imposed on businesses that need

immediate action. Therefore, with the help of a business loan, you are able to manage

the costs and expenses related to your business without delay. Must Read : The 6 Best Ways to Finance

Your Seasonal Business.

●

Small business loans help

businesses manage new orders for production and manufacturing. This makes it

very easy for small startups to manage the cost of the business in order to handle huge

orders in manufacturing and production.

●

Business loans are used by

startups in order to manage marketing and advertising costs. It is very

important to manage the online marketing schemes and strategies that make it

easier for businesses to market their products and lines of services.

Wrapping up

Get an instant business loan to manage the cost of starting a business.

You need to get an affordable business

loan interest rate from non-banking financial institutions like Clix

Capital.

Comments

Post a Comment