Assess Your Eligibility to Avail Home Loan from Clix Capital

If buying a home is all that is in your mind, you need a home loan from Clix Capital. It is important to meet the eligibility criteria in order to get instant approval and a low rate of interest. An affordable home loan with a paperless and hassle-free borrowing experience is easy with Clix Capital. Here is how you can meet the eligibility criteria imposed by Clix Capital in order to enjoy a fast home loan approval.

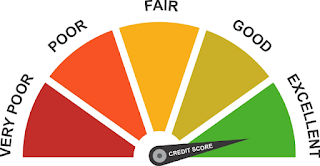

● Check your eligibility criteria: Credit

eligibility is marked with a credit score. Without a good credit score and a credit report, you will

not get a home loan. A good credit score which is above 750 is an important

eligibility criterion for you to get a home loan. To get a home loan from Clix

Capital you need to meet this eligibility criterion. If in case you are not

having a score above 750 you may get a loan but that will be expensive.

● A suitable income: A sufficient income is

necessary before you take up a huge burden like a home loan. If you choose Clix

Capital you will get the best experience of borrowing along with affordable

rates, but you need to have sufficient income in order to be eligible

for one. A home loan is a huge commitment that goes on for more than 20 years.

So, without judging the right financial stability a home loan will not be

offered.

● Down payment is important: If you need a home

loan you need to arrange a down payment. For Clix Capital, it is an important

eligibility criterion to understand if you are capable of arranging funds. If

you are not able to arrange the down payment, this does not speak well about

your financial health and a home loan burden will not be good for you or for

the loan provider.

● Get a good property: Being an NBFC of repute, Clix Capital believes in working with authenticity. If you are purchasing a home, make sure you go for a reputed brand or leading real estate agent. This helps you to get a good Property and makes it easy for the loan provider to recover the amount of your default. A good property is always a convincing point for a loan provider.

Wrapping up

With a home loan from Clix Capital, you can turn your dream into reality. The online fast home loan process is completely hassle-free and paperless to give you the best experience.

Must Read : Important

Home Loan Clauses that You should know

Comments

Post a Comment